France's unemployment is at its highest since 1999, at 10.6%. But wait! I thought France was supposed to be one of the stronger European Union powers, right after Germany. How problematic must the situation in Europe be if France is experiencing the same woes as that of neighbor Spain and Greece, with the only difference being degree?

Commodities Trading Analysis and News

Tuesday, March 12, 2013

Wednesday, February 27, 2013

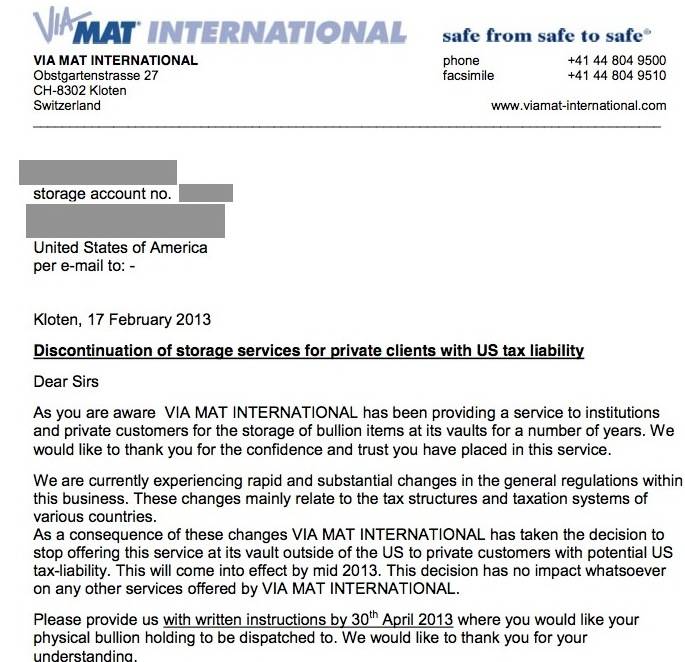

Via Mat rejecting US clients

Via Mat is the most reputable enterprise that ensures the storage of gold. It is used by the big bullion trading services such as BullionVault and GoldMoney, as well as mining companies. And when Via Mat makes a statement against a huge portion of its clientele, you know something major is going on. Not only something major, but something totally wrong.

In this case, it's the humongous regulations foisted on US citizens that make transacting with them inconvenient and annoying. The FATCA, or Foreign Account Tax Compliance Act, has been the US government's means of extracting revenue of Americans even from abroad. Looks like it's backfiring now, what with ViaMat issuing its letter discontinuing services for those "with US tax liability."

There will come a point when these US regulations will somewhat be eased, if only for the sake of adjusting to today's world. The fact is, the US government is becoming less responsive and wieldy, and is losing more and more money. There will come a point when its regulations could not even be implemented, which is a good thing for Americans who want to keep up with the goings-on of the market.

Sunday, February 10, 2013

Do You Know The Price of Gold, Give or Take 50%?

This is hilarious. Basically, Mark Dice is able to show just how little the man in the street knows about what is going on in the world, finance-wise that is.

I don't mean to seem arrogant about knowing better. There was a time, after all, that I didn't know this stuff about money either. I guess it's the only way my sad self could cope with watching the unbelievable blindness of most to what is happening to their money, their property.

Such ignorance is exactly why these clowns in office are able to fool the public with each crisis, which are both made by, and made worse by, government.

Maybe it will be a good sign when, in the future, Mark Dice chances upon someone who does know the price of gold. That will show that awareness is growing.

There is no need for you to wait that long. Buying gold at this time is the wisest decision I could impart to you.

Friday, January 25, 2013

Platinum/palladium infographic makes case for 'other metal/s'

Sprott Physical Bullion came out with this cool infographic on platinum and palladium. Basically, the story is that continued demand for platinum and palladium, whose supply is decreasing, will keep their prices up, along with gold and silver.

Also notice how China is a big factor in keeping up demand for platinum and palladium. This goes to show that it isn't the West that is dictating matters in the world, and in fact it hasn't been the West for quite some time.

The low-supply-high-demand story is actually the same story for silver, except of course silver, platinum and palladium do not have the same industrial uses. Nonetheless, they are all necessary in today's modern world, and they will be bid up in price to the degree that they are needed.

More unique to platinum and palladium is the labour troubles and political uncertainties constraining their production. Much of the production is done in Africa, a good portion of which has long been troubled. Whether or not things get better in the region, the continued production of platinum and palladium will be a must.

Platinum has a long way to go before outshining gold or silver, but it is no doubt becoming more popular, by the month.

Click below to see the full-size infographic!

Wednesday, January 16, 2013

The legacy of TARP: More TARP

Four years ago, the Troubled Assets Relief Program was passed, which basically cleared big banks of their worthless mortgage-derived securities. I remember when this initial bailout was proposed, it was justified on account of the banks being "too big to fail" (why didn't anyone express concern that these banks were too big to allow to do the stupid things it did to get in trouble?).

Wednesday, January 2, 2013

What happens to gold in 2013?

2013 expectations for the gold price are generally bullish, whether in the mainstream or among those in the know in the industry (yes, the mainstream can be considered to be lesser specimens when it comes to understanding of money and precious metals). Gold has taken a long-enough break since the last part of 2011, throughout 2012, and I really don't think it has anywhere else to go but up for this year.

Monday, November 19, 2012

Gold Scams: Don't Fall For Them!

|

| Photo from sammyboy.com |

This BullionStar article on scams in the gold market caught my attention. It's true. You might think that just because gold is a good investment, that you can just go along with whatever business that purports to take advantage of the rising price of gold. The truth is, scams are aplenty, and this is not just limited to the 'paper trading' going on with GLD, SLV and other ETFs. Even when it comes to physical gold, some people have somehow managed to come up with their own hare-brained Ponzi schemes.

Subscribe to:

Comments (Atom)